Noel News

Age is an issue of mind over matter

…if you don’t mind it doesn’t matter.

MARK TWAIN

Welcome to a new financial year,

and a whole new world of superannuation.

Major changes took place on 1 July and today I’m pleased to announce we have released a brand-new superannuation book to take the new changes into account.

This book is a totally new version, and the new book even has a changed title and a new cover to celebrate.

I’m aware that many of you have the older print version which we took off the website on 31st of May so today I’m announcing a new initiative to compensate those of you who own the old edition which is now out of date.

For the next four weeks the price of Super Made Simple print edition will be reduced from $29.95 to $19.95 and if you enter the coupon code SUPERSALE at the cart on my website, you’ll get free shipping. This means you can have the new book delivered to your door for just $19.95.

We’re also reducing the price of the e-book. The 5th Edition Ebook was $16.95, but now the fully revamped 6th Edition for 2024-2025 is on for sale for $12.95. If you have purchased the 5th edition ebook in the last 12 months, keep an eye on your inbox for a special upgrade offer.

Take advantage of these specials or grab a bundle – now with extra savings (usually $49.99) and as always, free shipping:

Here is a summary of the changes.

I gave you details of all the changes in the last newsletter – here is a brief recap:

Image by gpointstudio on Freepik

The preservation age for everybody is now 60. Until now people aged 59 could withdraw up to $235,000 from superannuation tax free. This is not relevant anymore. Once you reach 60, and you have satisfied a condition of release, you can withdraw all your superannuation tax-free if you wish.

Concessional contributions (the tax-deductible ones) have gone up from $27,500 a year to $30,000 a year. This includes the employer contribution which has just increased to 11.5% of your salary. The Super Contributions Calculator on my website has been amended to take this into account. If you’re over 50, increase your own salary sacrificed or personal contributions by the amount of your pay rise.

Non-concessional contributions (the ones made from after tax dollars) have gone from $110,000 a year to $120,000 a year. This is a perfect opportunity to boost your super if you are older and remember you can use the bring forward rule and contribute three years contributions in one lump. This means you can make $360,000 in this financial year if you have the money available and it suits your circumstances.

There are no changes to the downsizing contributions – the maximum of $300,000 a person still applies, and you can make only one downsizer contribution in your lifetime. However, a unique feature of these contributions is that you can make them irrespective of your age after age 55, or superannuation balance. This means the order in which you make contributions could be crucial. For example, if you had $1.6 million in superannuation and made a $300,000 downsizer contribution you would have reached your $1.9 million limit, and you could not make any more non-concessional contributions. If you made a $300,000 non-concessional contribution first, however, you could still make the downsizer contribution.

The transfer balance cap – the amount you can transfer to pension mode – remains at $1.9 million. But remember the original cap was $1.6 million when all the changes came in, and many people used up their cap then. Once you reach your cap, no more money can be transferred to pension mode, but there is still no limit on how much the money in pension mode can grow, which will happen if the earnings on your fund exceed the mandatory yearly pension withdrawals, and you leave that money to compound.

To explain the changes in more detail:

I’ve done a special 12 minute podcast.

You can find it on my

Interviews & Podcasts page or:

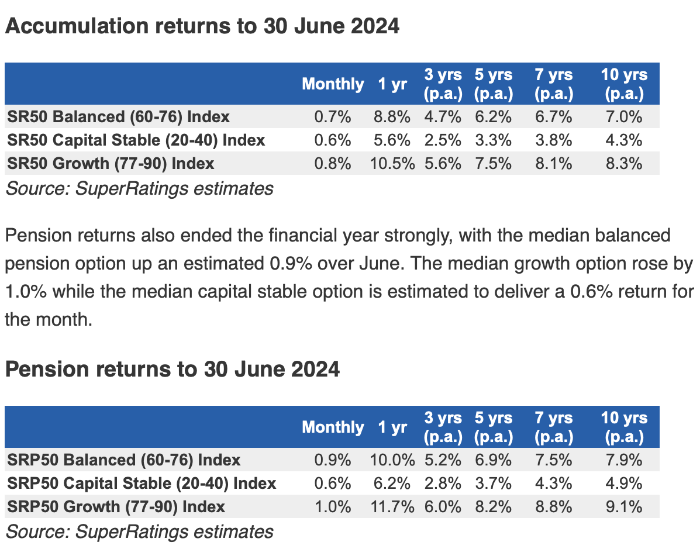

Latest super returns

The new year

The start of a new financial year is the perfect time to take stock of where you are and think about strategies for the coming 12 months. There is no doubt we are living in unusual times, but I have long believed that if you take charge of the things you can control, you should be well-placed to handle the things you can’t.

Inflation and rising interest rates look like the dominant factors for the coming year, and the Reserve Bank has made it abundantly clear that it will not hesitate to raise interest rates if it feels inflation is not under control. This week’s inflation figures told us that inflation is far from being under control, and the recent tax cuts can only make the situation worse. Markets are now factoring in a 54% chance of rates going up before September.

Image by Bob Rich for Hedgeye

Obviously, it is far better to prepare for a rate rise in advance than to find yourself in a financial bind when it happens. Therefore, try to maintain home loan repayments of at least $7 a thousand a month – that’s $2,800 a month on a $400,000 loan. Repayments at this rate will have your loan out of the way in 20 years, if interest rates are 5.5%. If they don’t go this high, your loan will be paid off much faster – and you will have given yourself a valuable safety buffer.

Your next pay will be higher than the last one because of the tax cuts which come into effect today. Seize the day! If you don’t commit this extra money right away, it will be frittered away. If you have a housing loan, increase your repayments by the amount of the tax cut. If you are salary sacrificing to superannuation be aware that the maximum deductible contribution has just risen from $27,500 to $30,000, so you can increase your contributions by at least $2500 a year. This, coupled with today’s rise in employer superannuation to 11.5%, will boost your retirement nest egg.

If you are over 55, pour as much money as you can into superannuation. Yes, you need to keep cash on hand for emergencies, but there is no point leaving money in bank accounts, where the interest is fully taxable, when you can move it to superannuation, where the income will be taxed at just 15%.

Remember too that a major benefit of placing money in super is that Centrelink does not count it until you reach pensionable age. For example, if one person was 67 and their partner was 59, moving a large amount of superannuation from the older to the younger person’s name could maximise the older partner’s age pension benefits.

Inertia is costly, and most of us suffer from it. Take an hour or so to go through all your regular payments, especially for those easily forgotten streaming services, magazine subscriptions and gym memberships, and suspend or cancel any which are not being used.

And don’t neglect your estate planning. If you don’t yet have a will, get around to it as soon as possible; if you do have a will have a family discussion to see whether it needs to be reviewed. Most people who do have wills never, ever get around reviewing them, and horrendous complications can arise as a result.

Most of my articles are built around this common theme: helping yourself so that you can have a more secure financial future. It is the actions you take today that will make the difference to your financial security in the long term.

The power of time and persistence

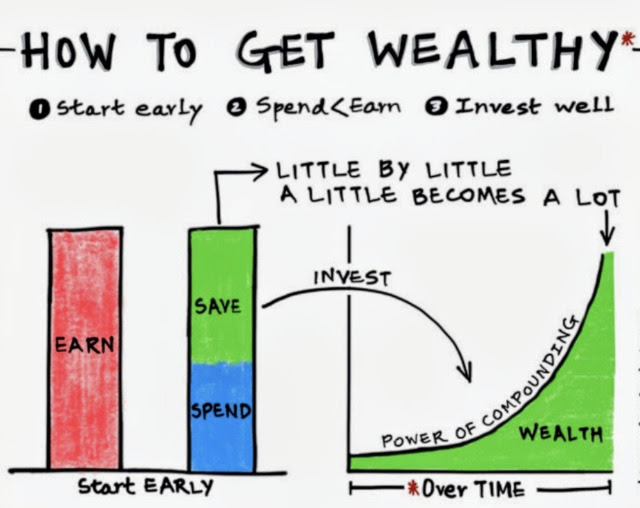

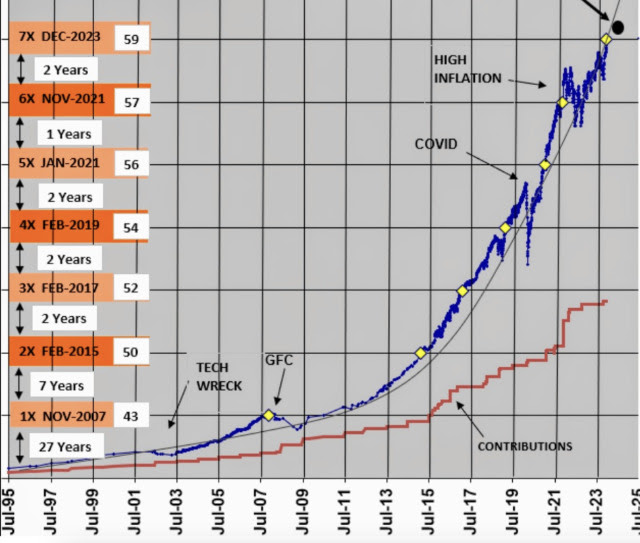

I received this last week – the diagrams were provided by the person who sent it. All his own work:

“I just wanted to thank-you so much for making investing so simple for the average person. I purchased my first copy of Making Money Made Simple in early 1990s and have followed your simple steps ever since.

I like to show any young person that will listen, your basic diagram of investing (see attached) and how compound interest works with growth exponential over time.

I then show a real life example of my super value since 1995 (without dollars shown). The graph shows the impact from the share market shocks during that time. The trend is still exponential and the shocks looking more like blips over time.

My wife and I have always been aggressive with our choice of investment by simply choosing International and Australian Index options in our super funds. This always produces higher returns and less fees. We then ride out the market shocks by adding more to super at the lower share prices.

I have been on a modest wage for most of my life and my wife had minimal super from her work so I always split my contributions. Her super is worth more than mine now…go figure!!

Our super combined is now almost $4M and we are now ready for retirement.

It is so straight forward…or…Making Money Made Simple.”

Noel’s next gig

On Wednesday 17th of July I will be doing a presentation to the U3A Toowoomba Investors Group at the Hume Ridge Church of Christ:

461 Hume Street, Kearney Springs.

They meet from 9:30 to 11:30 with a cuppa break at 10:30 for 15 minutes.

Admission is free, but you will need to register by emailing Crystal Wenham at. cwenham@live.com.au.

Look forward to seeing you there.

From the mail box

Image by benzoix on Freepik

“Thanks for your new book Wills, death & taxes made simple. Until I read it had no idea that a binding death nomination in superannuation lapses after three years.

Just checked mine and it has lapsed. Surely super funds should warn us that this is about to happen?”

Don’t play with fire

RACQ is urging us to be on the lookout for home fire dangers as insurance claims data revealed electrical issues were the leading cause of house fires.

General Manager Property and Niche Claims Paul Goan said RACQ had received 232 house fire claims in the past 12 months and 27% were caused by electrical problems.

“One of the biggest threats we’re seeing for large fires are lithium-ion batteries that are left to charge indefinitely and explode due to overcharging or faults,” Mr Goan said.

“We’re also seeing kitchen malfunctions, faults in camper fridges and even overheating wheat heat packs in microwaves as some of the causes for house fires.

Candles are another common cause, particularly ones that have been left near open windows where they can be blown over or knocked by curtains.

Over the past three years, RACQ Insurance has received claims for 705 house fires across Queensland, causing damages of $47.7 million.”

Mr Goan provided advice to protect yourself, your loved ones and home against fire.

“Check all of your electronics to ensure they are working properly, that you are using the correct charger, and remember to unplug your chargers before you go to bed or leave the house,” he said.

“You should also make it your priority to test your smoke alarms, discuss a fire evacuation plan with your household and pack an evacuation kit.

Of those surveyed, 45% hadn’t checked their sum insured value in the past 12 months. It’s important to choose a sum insured amount that is enough to cover the cost to rebuild your home and replace your contents if they are destroyed.”

And Finally

The Gray Matter test

This test makes you think before you answer!

1. Johnny’s mother had three children. The first child was named April. The second child was named May. What was the third child’s name?

2. There is a clerk at the butcher shop, he is five feet ten inches tall, and he wears size 13 sneakers. What does he weigh?

3. Before Mt. Everest was discovered, what was the highest mountain in the world?

4. How much dirt is there in a hole… that measures two feet by three feet by four feet?

5. What word in the English Language… is always spelled incorrectly?

6. Billy was born on December 28th, yet his birthday is always in the summer. How is this possible?

7. In California, you cannot take a picture of a man with a wooden leg. Why not?

8. What was the President’s Name…in 1975?

9. If you were running a race, and you passed the person in 2nd place, what place would you be in now?

10. Which is correct to say, “The yolk of the egg are white” or “The yolk of the egg is white”?

11. If a farmer has 5 haystacks in one field and 4 haystacks in the other field, how many haystacks would he have if he combined them all in another field?

Here are the Answers: (No peeking!)

1. Johnny’s mother had three children. The first child was named April. The second child was named May. What was the third child’s name?

Answer: Johnny, of course.

2. There is a clerk at the butcher shop, he is five feet ten inches tall, and he wears size 13 sneakers. What does he weigh?

Answer: Meat.

3. Before Mt. Everest was discovered, what was the highest mountain in the world?

it just wasn’t discovered yet. [You’re not very good at this are you?]

4. How much dirt is there in a hole that measures two feet by three feet by four feet?

Answer: There is no dirt in a hole.

5. What word in the English Language is always spelled incorrectly?

Answer: Incorrectly

6. Billy was born on December 28th, yet his birthday is always in the summer. How is this possible?

Answer: Billy lives in the Southern Hemisphere.

7. In California, you cannot take a picture of a man with a wooden leg. Why not?

Answer: You can’t take pictures with a wooden leg. You need a camera to take pictures.

8. What was the President’s Name in 1975?

Answer: Same as is it now – Joe Biden

9. If you were running a race, and you passed the person in 2nd place, what place would you be in now?

Answer: You would be in 2nd. Well, you passed the person in second place, not first.

10. Which is correct to say, “The yolk of the egg are white” or “The yolk of the egg is white”?

Answer: Neither the yolk of the egg is yellow [Duh]

11. If a farmer has 5 haystacks in one field and 4 haystacks in the other field, how many haystacks would he have if he combined them all in another field?

Answer: One. If he combines all of his haystacks, they all become one big one.

A big thank you to all you good people who read my newsletter.

If you were forwarded this newsletter by a friend and you would like to subscribe, you can do so here:

For more Noel News:

You can also find the subscription box in the footer of all website pages.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker