Noel News

Special Bulletin

The philosophy of the rich versus the poor is this ; the rich invest their money and spend what’s left; the poor spend their money and invest what’s left.

This is a special bulletin because I want to tell you about a webinar I’m doing next Thursday. But first, let’s start with an amazing story.

The passbook that grew

Image by Micheile Henderson on Unsplash

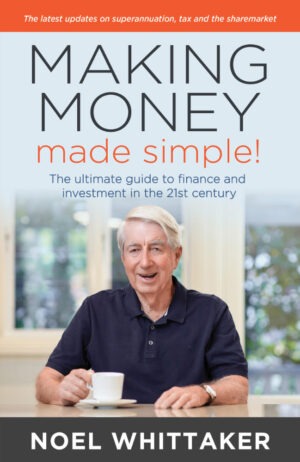

Thirty-seven years ago I released Making Money Made Simple, a book which has transformed the lives of thousands of Australians, and been named one of the 100 most influential books of the 20th century. Even now, seldom a day passes when I don’t receive emails from people telling me how much that book changed their lives. As of today the book has sold over 2 million copies, and we’ve just released the 25th edition. The information is as relevant now as it ever was.

One feature of that book was the suggestion that people pay their loans fortnightly instead of monthly. The banks scoffed then, but they had missed the main point – if you’re paying $2,000 a month and move to $1,000 a fortnight you have increased your repayments from $24,000 a year to $26,000 a year. That’s an extra $2,000 a year off your mortgage and you haven’t even missed it.

This led to my next concept – which I call the guaranteed secret of wealth. Put simply: you never miss money that you don’t see. That is, you don’t miss money that is deducted from your account automatically.

Illustration by John Shakespeare for SMH

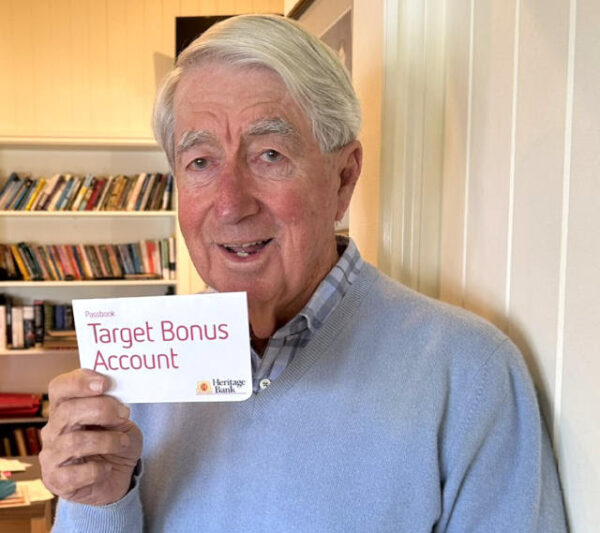

Back in 1993, to practise what I was preaching, I opened a savings account with Heritage Bank. In it I captured all the money I received that was not salary or investment income. This included things like tax refunds, automatic payments from health funds on the rare occasions I went to the doctor and even the one-off $1000 payment I got from Centrelink when the 2011 floods hit Brisbane.

It was fun to use the passbook, as I also enjoyed going into the Heritage Branch and chatting to the staff about my guaranteed secret of wealth while I watched the balance rise as they updated the passbook. Every time the balance hit $10,000 I withdrew that amount and paid it off a loan I had for an investment property. Using that strategy the investment property was paid off effortlessly – I would probably still have that loan if I had not used the guaranteed secret of wealth.

Recently, reflecting on this, I decided to find out exactly how much money had gone through that account in those 20 years. It was just a matter of going through all the old passbooks and adding up the withdrawals. Can you believe, in 20 years I had banked and withdrawn over $283,000! That’s how much I had managed to put away just by capturing all those relatively small amounts that normally end up in the everyday bank account and get frittered away.

In a few weeks, everybody will have a fatter pay packet because the tax rates are changing. Good money managers will put the extra money to good use by immediately increasing their home loan repayments by the amount of the tax cut, or by boosting their tax-deductible superannuation contributions. Remember, on 1 July the deductible contributions cap rises from $27,500 a year to $30,000 a year.

But before July has even finished, most people will have automatically increased their expenditure to soak up the tax cut, or will be wondering how they ever existed before the tax cuts happened. This is why, whenever I talk about budgeting I say: make investment your first expense. If you just give it a go, I promise you will be amazed by the result. You won’t be stuck – nothing stops you from pausing or ending the deduction. You could consider the money an emergency fund, if it helps, but unless you try it for yourself, you will never see how this concept really does work a kind of magic.

Get the ultimate guide to money, investment, borrowing and personal finance and experience the magic for yourself.

Get the ultimate guide to money, investment, borrowing and personal finance and experience the magic for yourself.

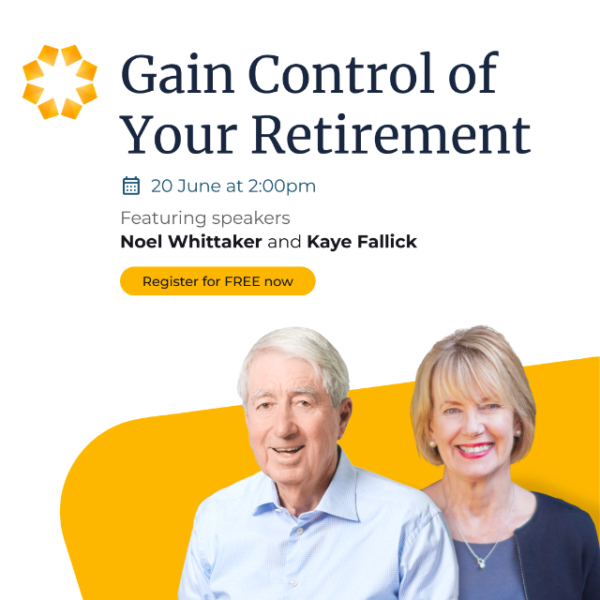

Webinar

Independence and choice are key to a happy and productive retirement. But many retirees have a ‘FORO’ (fear of running out of money), others simply feel they can’t control their finances while facing higher costs of living, volatile interest rates and share market uncertainty.

We all know that money can’t buy happiness, but it can go a long way towards making you happy with freedom, security, and the power to pursue your dreams.

That’s why I’d love you to join me in a webinar to discuss ways to Gain Control of Your Retirement. It’s the first in Household Capital’s five-part webinar series aimed to help you take control of your own retirement by understanding the basics of the Age Pension, super, government rules and the role the home plays in your income.

Webinar host, Kaye Fallick, and I will discuss these ‘levers’ of retirement funding and answer your questions along the way. I will also be giving away five copies of my latest book, ‘Wills, death and taxes made simple’.

The webinar is free – all you need to do is register here:

Join us on Thursday June 20 at 2pm for a lively discussion and explanation of the different levers of retirement income. This just may be the best 45 minutes you’ve ever spent! You’re very welcome to invite friends to attend as well and send any retirement income questions beforehand.

The journey of life

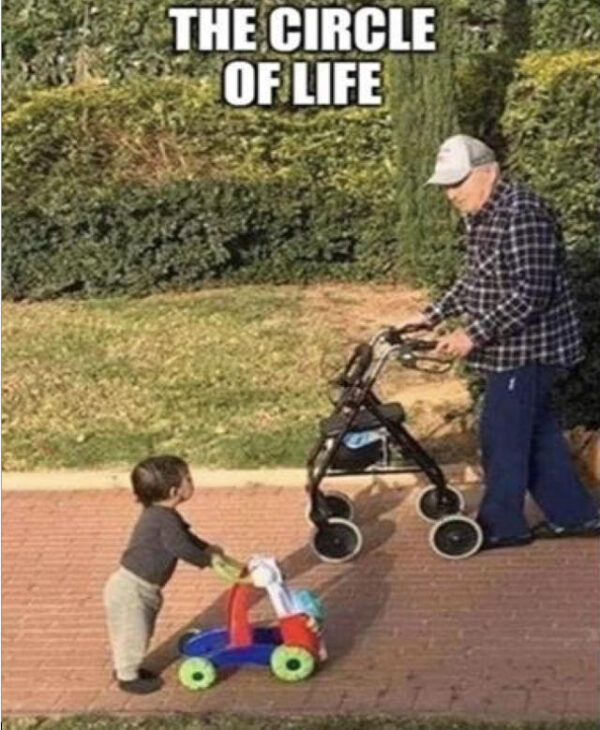

Recently we saw that wonderful movie The Great Escaper which is a 2023 biographical drama film starring Michael Caine and Glenda Jackson. It is based on the true story of 89-year-old British World War II Royal Navy veteran Bernard Jordan who “broke out” of his nursing home to attend the 70th anniversary D-Day commemorations in France in June 2014. It was showing in cinemas the couple of months ago but we got ours by buying a Blu-ray copy. We found it very moving, it really shows the stages of life given that Michael Caine is always shown on a walking frame.

Then one of my readers sent me this photo which touched my heart.

It made me think about one of my favourite pieces of poetry The Seven Ages of Man from As You Like It by William Shakespeare. It’s reproduced below – take a moment to think about it.

All the world’s a stage,

And all the men and women merely players;

They have their exits and their entrances,

And one man in his time plays many parts,

His acts being seven ages.

At first the infant,

Mewling and puking in the nurse’s arms;

And then the whining schoolboy, with his satchel

And shining morning face, creeping like snail

Unwillingly to school.

And then the lover,

Sighing like furnace, with a woeful ballad

Made to his mistress’ eyebrow.

Then a soldier,

Full of strange oaths, and bearded like the pard,

Jealous in honour, sudden and quick in quarrel,

Seeking the bubble reputation

Even in the cannon’s mouth.

And then the justice,

In fair round belly with good capon lined,

With eyes severe and beard of formal cut,

Full of wise saws and modern instances;

And so he plays his part.

The sixth age shifts

Into the lean and slippered pantaloon,

With spectacles on nose and pouch on side;

His youthful hose, well saved, a world too wide

For his shrunk shank; and his big manly voice,

Turning again toward childish treble, pipes

And whistles in his sound.

Last scene of all,

That ends this strange eventful history,

Is second childishness and mere oblivion,

Sans teeth, sans eyes, sans taste, sans everything.

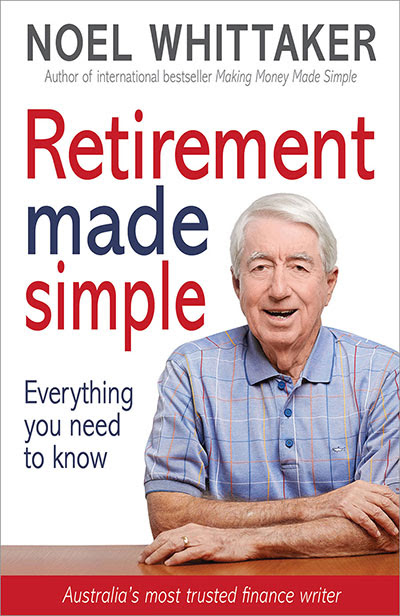

We need to understand that the ageing process is inevitable but as I wrote in Retirement Made Simple there is much the average person can do to help make the last 20 years of their life enjoyable and comfortable.

The key factors are exercise, diet, a sense of purpose and being part of a social network. These topics are explained in detail in the last chapter of Retirement Made Simple called Happiness and Fulfilment. Make sure you read it.

The Executors Cheat Sheet

We hope it will be finished at the end of this week. We’ve been focused on completing a completely new Superannuation Made Simple which has to be on the printing processes in time for the major changes which are happening on 1 July. Once we have a firm delivery date for the new book we will be giving you a special offer. In the meantime, the old book has been removed from our website.

Pension changes

The latest quarterly pension adjustments have been published, and as usual my website was the first to have them. The pension itself is unchanged but the thresholds have been increased. The bottom threshold for a homeowner couple has increased from $451,500 to $470,000 and the couples cut off point has gone from $1,254,500 to $1,283,000. For singles the figures are $314,000 and $686,250.

The easiest way to work out the increase you’re going to get is to use the Age Pension Calculator on my website and download the pension charts which are updated for the new figures.

You can find the latest version on my free downloads page any time or use the link below to download directly:

If you find this helpful, you’re sure to find Retirement Made Simple indispensable for navigating the rest of your decisions.

From the Mailbox

Great book mate!

I’m only up to page 86 and I’m running out of post it notes to attach to the relevant points.

We did visit our Solicitor about 5 years ago who is a “Wills, estates and probate specialist”, but a warning to all is that the Will she drafted has glaring omissions (hence the post it note reminders) that you point out in your book.

Time for a Will update and possibly a Solicitor change.

And Finally

DC “Ticket Agent” – Say WHAT?

Image by Drazen Zigic on Freepik

1. I had a New Hampshire Congresswoman (Carol Shea-Porter) ask for an aisle seat so that her hair wouldn’t get messed up by being near the window. (On an airplane!!)

2. I got a call from a Kansas Congressman’s (Moore) staffer (Howard Bauleke), who wanted to go to Cape Town. I started to explain the length of the flight and the passport information, and then he interrupted me with, ”I’m not trying to make you look stupid, but Cape Town is in Massachusetts”.

Without trying to make him look stupid, I calmly explained, ”Cape Cod is in Massachusetts, Cape Town is in South Africa.” His response — click*.

3. A senior Vermont Congressman (Bernie Sanders) called, furious about a Florida holiday package we did. I asked what was wrong with the vacation in Orlando. He said he was expecting an ocean-view room. I tried to explain that’s not possible, since Orlando is in the middle of the state.

He replied, “Don’t lie to me! I looked on the map, and Florida is a very THIN state!!” (OMG)

4. I got a call from a lawmaker’s wife (Landra Reid) who asked, ”Is it possible to see England from Canada?”

I said, ”No.” She said, ”But they look so close on the map” (OMG, again!)

5. An aide for a cabinet member (Janet Napolitano) once called and asked if he could rent a car in Dallas. I pulled up the reservation and noticed he had only a 1-hour layover in Dallas. When I asked him why he wanted to rent a car, he said, ”I heard Dallas was a big airport, and we will need a car to drive between gates to save time.”

6. An Illinois Congresswoman (Jan Schakowsky) called last week. She needed to know how it was possible that her flight from Detroit left at 8:30 a.m, and got to Chicago at 8:33 a.m.

I explained that Michigan was an hour ahead of Illinois, but she couldn’t understand the concept of time zones.

Finally, I told her the plane went fast, and she bought that.

7. A New York lawmaker, (Jerrold Nadler… he’s a real winner!!) called and asked, ”Do airlines put your physical description on your bag so they know whose luggage belongs to whom?” I said, “No, why do you ask?”

He replied, ”Well, when I checked in with the airline, they put a tag on my luggage that said (FAT), and I’m overweight.

I think that’s very rude!’’

After putting him on hold for a minute, while I looked into it. (I was dying laughing). I came back and explained the city code for Fresno, Ca is FAT – (Fresno Air Terminal), and the airline was just putting a destination tag on his luggage.

8. A Senator John Kerry aide (Lindsay Ross) called to inquire about a trip package to Hawaii. After going over all the cost info, she asked, ”Would it be cheaper to fly to California and then take the train to Hawaii?”

9. I just got off the phone with a freshman Congressman, Bobby Bright from Ala who asked, ”How do I know which plane to get on?”

I asked him what exactly he meant, to which he replied, ”I was told my flight number is 823, but none of these planes have numbers on them.”

10. Senator Dianne Feinstein called and said, ”I need to fly to Pepsi-Cola, Florida. Do I have to get on one of those little computer planes?”

I asked if she meant fly to Pensacola and fly on a commuter plane.

She said, ”Yeah, whatever, smarty!”

11. Mary Landrieu, LA. Senator, called and had a question about the documents she needed in order to fly to China .

After a lengthy discussion about passports, I reminded her that she needed a visa. “Oh, no I don’t. I’ve been to China many times and never had to have one of those.”

I double checked and sure enough, her stay required a visa. When I told her this she said, ”Look, I’ve been to China four times and every time they have accepted my American Express!”

12. A New Jersey Congressman (John Adler) called to make reservations, ”I want to go from Chicago to Rhino, New York.”

I was at a loss for words. Finally, I said, ”Are you sure that’s the name of the town?’’

‘Yes, what flights do you have?” replied the man.

After some searching, I came back with, ”I’m sorry, sir, I’ve looked up every airport code in the country and can’t find a rhino anywhere.”

”The man retorted, ”Oh, don’t be silly! Everyone knows where it is. Check your map!” So I scoured a map of the state of New York and finally offered, ”You don’t mean Buffalo, do you?”

The reply? ”Whatever! I knew it was a big animal.”