Noel News

“First we’re children to our parents

then parents to our children

then parents to our parents

then children to our children.”

MILTON GREENBLATT

Good morning

I’m writing this from Los Angeles, where we are visiting our son James and his family. It’s our first overseas trip for three years, and nothing much has changed in America except the horrendous prices, due to the surging Greenback. The United Airlines flight ex-Sydney was uneventful, and it was great to discover that masks are no longer required – neither on the aeroplane nor in the airports.

On the advice of friends, we invested $90 for two Apple AirTags which sit inside your suitcases and enable them to be tracked anywhere in the world. Luckily, our luggage arrived on time, but it was good to know that the AirTags were there as a backup.

We did have an initial scare when we arrived at Sydney – when we were getting off the plane our phones told us “your luggage was last seen at Brisbane Airport” – it was temporary, once the baggage came off the plane our phones told us that our luggage was very close.

Our plane left Sydney at 10:30 am – but we came down the day before because daylight saving had just started, which meant departure was 9:30 am Brisbane time. That was too much of a risk to attempt on the same day.

We stayed at Rydges hotel at the international airport which was the perfect choice. It’s a one-minute walk from the international terminal check-in desk which took all the worries and cost out of taxis and connections and possible traffic hold-ups. It’s a good basic place to stay – we were there on a public holiday but there were still a good pub type bar with sufficient menu for dinner.

Travel always has its challenges and the first one was getting travel insurance for me. Once you get to 80 it becomes extremely difficult. After searching online I contacted National Seniors, who offered a comprehensive policy for $1449 – that’s after deduction of my 10% members discount. It’s a hefty sum for a three-week journey! On the recommendation of a reader I phoned RACQ, where I have my home and car insurance, and got a policy for $909. It was less comprehensive, but does cover the big-ticket health emergencies, which is the main reason for travel insurance.

Next, we needed to arrange finance. The days of travellers checks and carrying cash are long gone, and debit/credit cards have become the way to go. I’ve been here for a fortnight now and have never resorted to cash – I just swipe my card when asked. My favourite cards for travelling have long been the ING debit card and the Latitude credit card. They both have useful apps, so you can see exactly what something has cost a moment after you swipe the card.

The ING card is a debit card, so there are no nasty shocks when you get home, and the statement arrives. Furthermore, the ING card refunds all the hidden commissions, which no other card does, to my knowledge. I have spent around $3000 since arrival and they have already refunded $90 in commissions. It’s averaging about 3% of whatever we spend.

The Latitude card, on the other hand, is a credit card with a limit. They claim it’s “commission free” – which means they don’t charge you any commissions themselves – but they don’t give you any back.

Scammed

But life is never simple. I love using credit and debit cards that have an app connected to my phone because I can keep track of all my spending hour by hour. It paid off on this trip.

I was browsing through the ING app on the fourth day of our trip and discovered six consecutive transactions to Microsoft: four were for zero dollars and two were for one dollar. My alarm bells went crazy, and I contacted ING, who confirmed that it was a scam; the card had to be cancelled immediately.

Fortunately, because we also carry Latitude credit cards we still had a working card. It’s a reminder to always have at least two ways to access money when you travel overseas. I’d hate to think what would happen to anybody who was on their own and had only one card. If that gets stopped, which is not improbable, they’d be penniless.

Travelling? Do a budget.

We are staggered by the cost of things in Los Angeles. A typical breakfast costs around US$21. That’s $16 for the food and $5 for the coffee. Add a 9.5% state tax and it becomes $23. Now add the 20% tip and you’re up to almost $28. In the last week or so the American dollar has surged in value, so the conversion rate to the Australian dollar is now about 1.6. That means a simple breakfast comes out to AU$45 a head. And that’s just to get the day going – there’s lunch and dinner on top of that. I guess one good thing about eating out in America is the portions are huge – this means that Geraldine and I could share a starter, and also a main course. That does halve the price.

I guess the lesson for anyone contemplating an overseas trip is to get a handle on what the cost will be in Australian dollars at the destination. Based on these figures I reckon it would be hard for a couple to get by on less than AU$1000 a day, including accommodation, in many places. When you add the cost of airfares, which have doubled since we last travelled, even a simple trip to visit family can quickly becomes an expensive experience.

The new book

Thank you all for your tremendous support of my new book. Orders have been pouring in, and I know it will be of tremendous benefit to your children and grandchildren.

Three of the major points in the book are to spend less than you earn, become an effective goal setter, and understand the importance that time and rate makes to the investment outcome.

Recently I was reading about a person aged 22 who was well on the way to getting a deposit together to buy their own home. They were working three jobs to create the money needed, and were focused on their goals. Think about it – if we can instill a mindset in a young person whereby they spend less than they earn, where they are goal orientated, and understand the value of time and rate to make compounding work its magic, we have given them a foundation that could almost guarantee them financial independence. The sad reality is that 80% of people never get to this stage.

I have received numerous emails asking whether it will be available as an e-book, and I can confirm that by the end of October the e-book will be available. The printing of the physical book was held up a little because of all the public holidays that occurred around the date of the death of the Queen, but I’m fairly confident the book should be in your hands by the end of this month. Given the huge backlog of distribution channels with books, I can’t imagine it will be in the retail shops before next year, so get in now.

Possible super changes

As budget night draws rapidly closer, the noise about possible superannuation changes is getting louder. The Financial Services Council (FSC) has recently argued that the “piecemeal” superannuation taxes currently being canvassed will not deliver a sustainable federal budget position, but will instead have a severe impact on people’s retirement.

These “piecemeal” taxes include the introduction of a $5 million limit on total superannuation balances, a reduction in the tax concession on pre-tax contributions, and the introduction of a flat tax on all earning in retirement of 15 per cent.

Earlier this month, the Australian Institute of Superannuation Trustees (AIST) reiterated calls for the introduction of a $5 million limit on total superannuation balances. The group asked the Labor government to require individuals that exceed that $5 million cap, of whom there are 11,000 according to the Retirement Income Review, to withdraw the excess amount by 1 July 2024.

Back in February, Mercer too demanded that super be capped at $5 million citing inequality in Australia’s super system as a key motivator. At the time, Mercer also argued that a 15 per cent tax rate should be applied to all investment income received by super funds, while a concession of 15 to 20 per cent should be provided for all concessional contributions below existing annual limits.

Don’t forget this is all rumour. But keep in mind that the biggest factor which determines how much money you have when you retire, and how long your money would last after you retire, is the rate of return you can achieve. Changing retirement accounts from being tax-free to suffering a 15% tax on earnings would take at least 1% off the net return. Just check the numbers for yourself by having a play with my retirement drawdown calculator on my website – the effects can be massive long-term.

Superannuation Made Simple

We are due back in Australia before budget day. I’ll be getting out a special bulletin soon after that as possible.

Interest rates

Inflation is the big topic all over the world, and I don’t see much sign of it falling in Australia soon. Just last week there were forecasts that electricity prices would be going up by 35% within 12 months – there’s no surprise in that, but I was surprised to see economists forecasting that this would add .6% to our inflation rate and therefore be a trigger for the Reserve Bank to raise rates even more.

I just don’t get it – mortgage rates coupled with rising power prices and petrol prices are already squeezing families. The purpose of increasing rates is to reduce demand in the community to stop people spending and pushing up prices. Surely a 35% jump in power prices plus the ongoing increases in interest-rates and fuel would be more than enough to stop unnecessary spending. Spending on power, fuel and mortgage payments is not discretionary – it’s money you just have to spend.

But it’s going to get worse. I think we’ll see another rise from Reserve Bank on 1 November, and the central banks in America, United Kingdom and most of Europe have made it very clear that they will push rates up until the economy breaks. Spare a special thought for the ordinary American – over the last 41 years the total increase in their take-home pay after adjustment for inflation has been just 6.9% – that’s not 6.9% per year it’s a total of 6.9% over 43 years.

Granny flat traps

The media in Queensland has been full of headlines about the number of homeless people who are sleeping in cars or camping on friend’s lounges because they simply can’t find anywhere to rent. In what they claim is a solution to the problem the Queensland government has announced they are changing the granny flat laws to allow anyone who wishes to rent out the granny flat to non-family members to do it. It may be good in theory, but it’s full of dangers in practice.

Anybody who is a landlord in Queensland should be aware that huge changes took affect from 1 October 2022. For starters the option to end a period tenancy with no grounds will no longer be available to property owners. The new laws prescribe very specific reasons available to a landlord who wants to end a periodic tenancy. These include the end of a lease agreement, repairing the property for sale which requires vacant possession, owner or relative moving in, the change of use of the property, or significant repairs of renovations and demolition redevelopment.

Then there are new laws regarding negotiations for pets. The landlord is almost forced to accept the pet unless they have strong reasons to object. Possible reasons include keeping the pet would exceed a reasonable number of animals being kept at the premises, the premises are unsuitable for keeping the pet because of lack of appropriate fencing, open space or another item necessary to humanely accommodate the pet, or that keeping the pet is likely to cause damage to the premises.

These controversial new laws have put the landlord at the mercy of the tenant. This is why many landlords in Queensland are now moving to Airbnb. I suggest renting out a granny flat at your home could be a dangerous strategy.

Seminar in Mackay. Tuesday 8 November

![]()

If you’re interested in learning more about retirement, or my views on the budget, come to the seminar I’m presenting in Mackay next month.

The title is Navigating All Stages of Retirement – Made Simple. It’ s being put on by my good friend Julia Hartman and her organisation BAN TACS.

It will go from 4pm to 6pm and the venue is Souths Leagues Club. Entry is free but it’s important that you register your interest to make sure a place can be reserved for you.

To do this just contact 1300 022 682.

Health Matters

During a recent skin check recently the doctor asked me if I was taking vitamin B3 supplements. I replied in the negative and he gave me a brochure recommending a daily dose of 500 mg. According to the brochure exposure to ultraviolet radiation in sunlight increases the risk of skin cancer by damaging the DNA in skin cells and suppressing the immune system’s anti-cancer response. Vitamin B3 protects against this immune system suppression. It does not prevent damage to the skin cells caused by UV radiation so it’s still very important to stay sun smart. The handout said the observed effects from taking vitamin B3 were that solar keratosis were reduced by 13% and development of new non-melanoma skin cancers was reduced by about 20%.

I dutifully went to my local pharmacy who agreed with the brochure and said this was a “fairly new thing”. The pharmacist sold me a jar of Blackmores Insolar that is claimed to be a patent protected formula to support skin integrity and skin health. It contains vitamin B3 in nicotinamide form. A web search of vitamin B3 in nicotinamide form will show you a wide range of products as well as provide much more information.

A great podcast

The purpose of this newsletter has almost been to convey accurate information in as simple format as possible. But there is only so much you can do in writing. This is why I am so pleased to include the latest podcast featuring my friend Ashley Owen the Chief Investment Officer of Stanford Brown, one of Australia’s leading financial advisory firms.

In this 41 minute episode he talks about the state of the world at the moment, where interest-rates are heading, the chances of a recession in Australia and what that would mean for stock markets., He also gives a brilliant discussion on the history of government bonds and the interplay between bond markets and governments. Don’t miss it.

A link is here but in my experience you better off to go to Spotify and subscribe to the SB Talks Podcast – that makes it much easier to stop and rewind and start again if you wish.

Before you start listening to that podcast I’ll give you an overview of the way bonds work.

The thing about bonds is that their market value increases as interest rates drop. Obviously, if I have a government bond paying 4% per annum, and rates drop to 2% per annum, the value of my bond will rise ,because 2% has become the current going rate, and my bond is paying 4%. So, in the last 10 years as interest rates have gone down and down and down, bonds have had a bull market. But those days are gone. Most government bonds in Europe are now yielding negative returns, but under European law pension funds are forced to invest in them. Therefore, fund managers are investing heavily in bonds which they know they will lose money on.

In my newsletter of 17th of April 2020 I wrote:

“A term favoured by the media, and one which I hate, is “investors are fleeing to the safety of bonds.” Last Thursday, the government issued $13 billion of 4.5 year government bonds at a yield of 0.47%. The ABC seemed to be saying what a safe investment these bonds were because you have a “government guarantee that in 4.5 years time you’ll get your money back, plus 0.47% interest along the way.” Are they serious!? It wouldn’t even cover inflation.”

And Finally

A BRAIN TEASER

See if you can figure out what these words have in common:

1 Banana

2 Dresser

3 Grammar

4 Potato

5 Revive

6 Uneven

7 Assess

Are you peeking or have you already given up? Give it another try. Look at each word carefully. You’ll kick yourself when you discover the answer.

Scroll down to Answer

Answer:

No, it is not that they all have 2 sets of double letters.

Real Answer:

In all of the words listed, if you take the first letter, place it at the end of the word, and then spell the word backwards, it will be the same word.

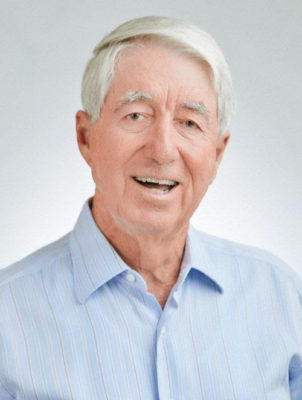

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker