Noel News

A bad attitude is like a flat tyre –

you won’t get very far until you change it.

JOYCE MEYER

Welcome to another newsletter

I am writing this on Thursday, 11 August and am pleased to report that our long-delayed renovations are finally proceeding smoothly. Better still there has been a good pick up in markets since my last newsletter and I have used the opportunity to cash in part of my investments to restore the liquidity I lost when the renovations went way over budget. I hate cashing in investments, but I would rather have a bit less money in super and a bit more money in the bank in these challenging times.

Interest rates have just increased by 50 basis points taking the cash rate to 1.85%. It was no surprise – the Reserve Bank has made it clear that rate rises will continue until interest rates reach a level that they regard as normal. The bank has also hinted that they would prefer to move in 50 basis points steps. This begs the question as to how far rates will go.

There are two very different viewpoints as to what the future may look like. I hear claims that after a year or so inflation will turn negative, and the bank will start reducing rates again. My view is the opposite and, given the historical unreliability of any economic forecasts, I’ll share my reasoning now.

First, consider the way the Reserve Bank is thinking. They are well aware they screwed up badly by cutting rates far too low, and then leaving them down far longer than was appropriate. And the bank never wants to be seen as making ad hoc decisions based on short-term data. So, it is likely the bank will stop moving rates once they are satisfied their target has been reached, and then sit on their hands.

Second, a major cause of inflation is electricity prices. Speak to anybody in the industry and they will tell you that the electricity crisis will not be solved easily and may last for years. In the United Kingdom electricity prices have doubled in the last year, and are forecast to double again in the next 12 months. Imagine the effect on your budget if that happened here. I’ve bitten the bullet and installed a serious solar and battery system as part of the renovations at home. I know it might take eight years to get my money back but I’d rather be sure and sorry.

Third, there are the shortages caused by the war in Ukraine. It was all gung-ho at the start, with predictions that Putin would give up easily and crawl back into his bunker. As is now becoming clear, this was never going to happen, and Putin’s position looks stronger than ever. Russia has already destroyed 95% of Ukraine’s critical infrastructure and taken complete control of eastern Ukraine. This means Putin is controlling the flow of gas to Europe, which is likely to force them into recession as winter comes. As a result, they are losing their appetite for sanctions on Russia. There will be no quick solution here – expect a long campaign, and the shortages caused by the war to continue.

Fourth, think about inflation caused by wage increases. Workers have never had it tougher. Power bills are skyrocketing, petrol is taking an ever bigger chunk of their income, bills are increasing, and now they are copping a pounding with increasing mortgage repayments. Let’s say inflation is 7%. Even if the average worker gets a massive 7% wage increase, to keep up with inflation, tax will take 32.5% of that increase. So they will only have a real increase of 4.7% in their pocket, and they are still worse off. Of course they will fight for wage increases.

Finally, another major inflationary driver is the building industry. Shortages of supplies and skilled workers are getting worse and worse, and builders are going broke all over the country. If you tot up the jobs that are remaining unfinished due to builder bankruptcies, and all the work that needs to be done to fix fire and flood damage, it’s obvious the building industry will continue to be in huge demand in the next few years.

And it’s not just the building industry struggling: throughout the world, staff shortages are at unprecedented highs. Many restaurants and holiday resorts are now forced to curtail the number of clients they can accept, because there are not enough staff available to provide the services. Does anyone seriously think that all these workers will suddenly reappear in a year or so? We recently had friends from Edinburgh staying with us and they told us that the famous Balmoral hotel in Edinburgh has two floors open right now.

If you put all this together, I see no reason to suggest things will be back to normal in a year or so. My view is that the Reserve Bank will keep raising rates until they reach 4%, and leave them there for quite a long time. This is not the time to be complacent: take a good look at your finances and put safety buffers in place to safeguard your position for what lies ahead. These include making sure you are maximising your Centrelink entitlements, that your superannuation is in the asset class that is appropriate for your risk profile, and you have sufficient money in cash type areas for the next three years expenditure.

It’s the percentage – not the dollar amount

I’ve been receiving a stack of emails asking whether to hold off making contributions to superannuation until the market had improved. I pointed out that trying to time the market is a mugs’ game, and that the biggest rises in share markets normally come very quickly when the bottom has been reached.

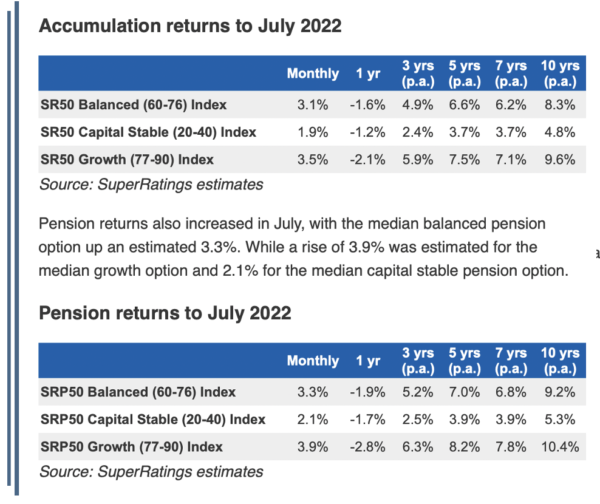

These days people can expect to live well past 85 – superannuation is a long-term investment in which you keep assets in a low tax, or even zero tax, environment. Good superannuation funds have averaged 8% per annum for many years – but this is not a straight line return. More likely it is 15% one year, 6% in another and even a negative return in some years.

When markets are down, continuing to contribute offers a great opportunity to boost your superannuation when assets are selling at bargain prices.

But you also need to think of any fluctuations as a percentage, and not in absolute dollars. I got an email last week from a person in the health industry who was in a panic because her superannuation had fallen by $20,000. She is 61 and single. I asked her how much she had in super and she replied $800,000. I pointed out to her that a 5% fall in a person’s superannuation balance is not abnormal ,but it could mean a drop of $40,000 in her balance.

The other side of the coin is that increases of 18% over a year are not unusual. If her fund increased by 18% her balance would rise by $144,000. Don’t be phased by short-term fluctuations. And as I have pointed out many times, delaying your retirement by five years could increase your superannuation balance by 40%.

The superannuation figures to 31 July are just in. Notice in the month of July the average superannuation fund rose 3%.

Talk back

I love doing talkback radio because it’s a great way to get in touch with the real world. A couple of months ago I did a broadcast for ABC Sydney – here is a sample of the issues raised.

One call was from a woman who had won a financial consultation with an “adviser” in a “lottery”. She was 55, had no investment experience whatsoever, and was happily invested in one of the better performing superannuation funds. This “adviser” urged her to start a self-managed super fund and transfer her existing super to it. When I asked her what his reasoning was, she said he told her she could get better returns than her fund was getting. I warned her against it: this kind of advice has red flags all over it! The fact that she “won” the consultation in a so-called lottery is highly suspect, and any advice to start a self-managed fund should be treated with suspicion, unless the client is experienced in financial matters, and is keen, and able to do their own thing.

Another call was from a 68-year-old woman who told me she was worried sick. Apparently late last year she withdrew $84,000 from her superannuation fund, and lent it to a good friend. The good friend dutifully paid it back with a cheque, but her super fund refused to accept it as a contribution because of her age. I had good news for her – that was last year’s problem. Since 1 July, when the superannuation rules changed, anybody can contribute to superannuation to age 75 without passing the work test, unless they had more than $1.7 million in superannuation. Problem solved.

Another caller was keen to help his son buy his first home. He figured that he and his wife could be partners in the purchase, which would enable their son to buy the property. I pointed out that this would most likely cause problems down the track, as owning a substantial share of an appreciating asset could hinder and possibly even prevent their eligibility for the age pension when it was time to apply for it. Furthermore, there could be substantial capital gains tax to pay when they decided to transfer the property to the son. The other factor is that even if they made a gift of their equity in the property to the son, it would be held by Centrelink as a deprived asset for five years, which could have a big impact on any pension. A much better option would be to guarantee their son’s loan – it should still enable him to qualify for a loan if all of the other conditions were satisfactory, and they would not suffer the problems mentioned above.

These are all common questions, and as you can see, the answers vary in complexity. There are a few simple principles though. Remember that people offering you “free” advice expect to get a generous payback, or they wouldn’t bother. Check your superannuation rules before you make any changes to it – your fund should have someone you can talk to. Don’t try to time the market: invest regularly, or whenever you can. And last but not least, for something more complex, like helping someone buy property, or setting up an SMSF, you need to find a reputable financial adviser. Their advice will cost you, but it should save you their fee, and then some.

The joys of travel

In my last newsletter I mentioned some of the challenges of international travel. This week we decided to fly to Los Angeles to visit our son James and his family. I phoned Virgin who have been my preferred airline for many years to talk about fares. We got a quote for business class for $10,000 each which was more than we expected but which we were prepared to pay. When I rang back next day to confirm the flights, which were on hold, I was told the price has increased to $15,000 each.

When I expressed my shock at the 50% increase I was told if I left one day earlier the price would return to $10,000! It was no trouble leaving a day early, but it’s a warning to anyone booking overseas flights. We then thought about our booking which had us leaving Brisbane at 5:30 am to catch a connecting flight to Los Angeles at 11:30 am on the same day – we figured the transit time was too short and that we would be better off going down the night before. This increased the fare by $250 a person and, as well, a change fee of $400 a person. All this rigmarole has drastically decreased my appetite for international travel.

International travel finance

I have long recommended the ING debit card as the perfect card for travelling overseas. Their exchange rate is great and they refund the hidden commissions which nobody else seems to of heard of.

After I booked the flights I applied for ESTAs for Geraldine and myself. That’s a fancy name for an American Visa. The fee was $US22 each. In the interests of research, I paid one on my American Express card and one on my ING debit card. Amex charged $31.10 including a conversion fee of $.91. ING charged $31.31 including a $.91 conversion fee which they refunded. Therefore, the net cost was $30.40. I know these are tiny numbers, but if you’re spending big money on travel overseas it really mounts up.

Books

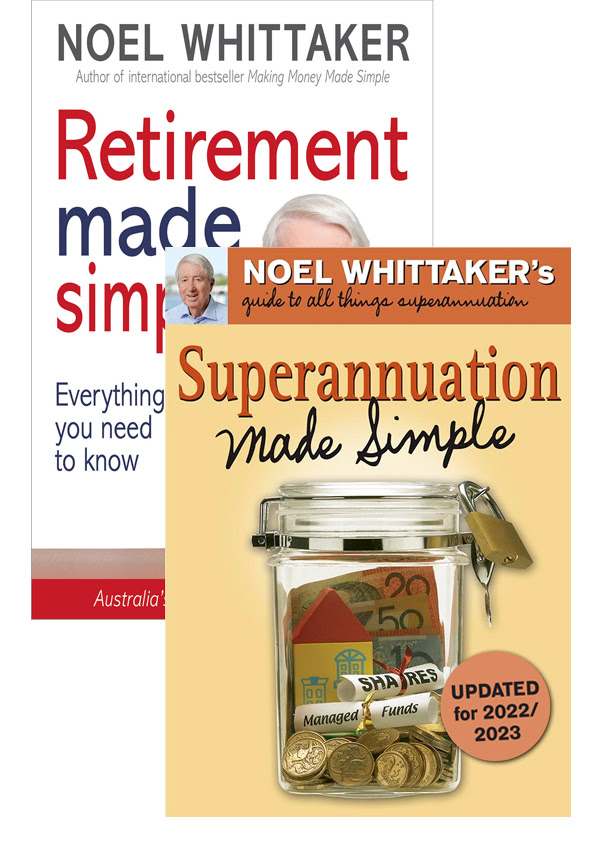

We’ve still got a small number of the current edition of Retirement Made Simple left, and I’m extending the special offer I made in the last newsletter whereby you get the current version together with the new updated superannuation book.

There is a special bundle enabling anyone who buys a copy of the current retirement book to get the new superannuation book at a heavily discounted price. The bundle of the two books has been slashed from $47.99 to just $36.99. This offer can only last until stocks of the retirement book are all gone.

The new edition of Retirement Made Simple is coming off the presses at the end of this month.

I’m now receiving emails asking when my new book 10 Steps To Financial Freedom will be available. It’s in its final stages and we hope it’ll be on the presses in two weeks. You’ll be the first to know when it’s available. It’s come up beautifully.

|

Long ago and far away, in a land that time forgot,

Before the days of Dylan, or the dawn of Camelot.

There lived a race of innocents, and they were You & Me,

We longed for love and romance, and waited for our Prince,

Eddie Fisher married Liz, and no one’s seen him since.

We danced to ‘Little Darlin,’ and sang to ‘Stagger Lee’

And cried for Buddy Holly in the Land That Made You & Me.

Only girls wore earrings then, and 3 was one too many,

And only boys wore flat-top cuts, except for Jean McKinney.

And only in our wildest dreams did we expect to see

A boy named George with Lipstick, in the Land That Made You & Me.

We fell for Frankie Avalon, Annette was oh, so nice,

And when they made a movie, they never made it twice.

We didn’t have a Star Trek Five, or Psycho Two and Three,

Or Rocky-Rambo Twenty in the Land That Made You & Me.

Miss Kitty had a heart of gold, and Chester had a limp,

And Reagan was a Democrat whose co-star was a chimp.

We had a Mr. Wizard, but not a Mr. T,

And Oprah couldn’t talk yet, in the Land That Made You & Me.

We had our share of heroes, we never thought they’d go,

At least not Bobby Darin, or Marilyn Monroe.

For youth was still eternal, and life was yet to be,

And Elvis was forever in the Land That Made You & Me.

We’d never seen the rock band that was Grateful to be Dead,

And Airplanes weren’t named Jefferson, and Zeppelins were not Led.

And Beatles lived in gardens then, and Monkeys lived in trees,

Madonna was Mary in the Land That Made You & Me.

We’d never heard of microwaves, or telephones in cars,

And babies might be bottle-fed, but they were not grown in jars.

And pumping iron got wrinkles out, and ‘gay’ meant fancy-free,

And dorms were never co-Ed in the Land That Made You & Me.

We hadn’t seen enough of jets to talk about the lag,

And microchips were what was left at the bottom of the bag.

And hardware was a box of nails, and bytes came from a flea,

And rocket ships were fiction in the Land That Made You & Me.

T-Birds came with portholes, and side shows came with freaks,

And bathing suits came big enough to cover both your cheeks.

And Coke came just in bottles, and skirts below the knee,

And Castro came to power near the Land That Made You & Me.

We had no Crest with Fluoride, we had no Hill Street Blues,

We had no patterned pantyhose or Lipton herbal tea,

Or prime-time ads for those dysfunctions in the Land That Made You & Me.

There were no golden arches, no Perrier to chill,

And fish were not called Wanda, and cats were not called Bill.

And middle-aged was 35 and old was forty-three,

And ancient were our parents in the Land That Made You & Me.

But all things have a season, or so we’ve heard them say,

And now instead of Maybelline we swear by Retin-A.

They send us invitations to join AARP,

We’ve come a long way, baby, from the Land That Made You & Me.

So now we face a brave new world in slightly larger jeans,

And wonder why they’re using smaller print in magazines.

And we tell our children’s children of the way it used to be,

Long ago and far away in the Land That Made You & Me.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker